Saving for a Down Payment in Canada: 2025 Guide

Updated: September 2025

Introduction

In Canada, saving for a down payment is one of the most important tasks before buying your first house, but it can also feel overwhelming. The criteria are the same whether you're looking to buy in Toronto, Ottawa, Calgary, or a smaller community: you need a solid savings plan, specific targets, and an understanding of the programs that can help Canadians save more.

September 2025: The Bank of Canada’s policy rate remains steady at 2.75% since July. This has affected the affordability of mortgages and how Canadians save for a down payment.

Everything you need to know about saving for a down payment on a home in Canada is broken down in this guide, which also it includes tools, advice, and actual case studies from Canadian homeowners who made that happen.

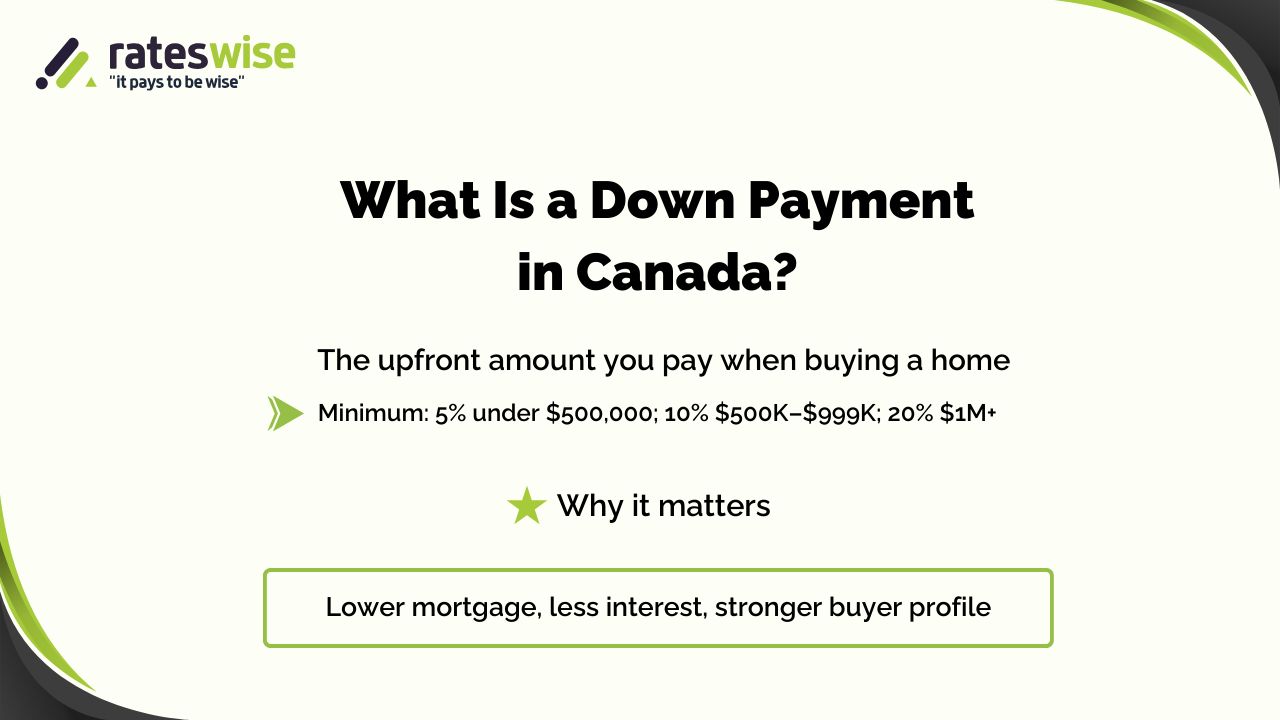

What is the required down payment amount in Canada?

The minimum amount needed for a down payment on a home is determined by the home's price:

- For residences under $500,000, five percent of the buying price.

- 10% of the amount in the $500,000–$999,999 range

- 20% of properties over $1,000,000 are exempt from CMHC insurance.

👉 For example: your down payment for a $600,000 house in Ontario would be $25,000, or 5% of the initial $500,000

- $10,000 is 10% of the next $100,000.

- $35,000 in total.

For this reason, saving for a down payment in Canada requires consistency and planning.

Advice on How to Save for a Down Payment

The little things add up when it comes to saving for a down payment. Learn these methods that are used by Canadian homeowners:

Save money automatically → Make a special account and set up automatic transfers for each paycheck.

Cut major expenses → The biggest expenses can be rent, transportation, and dining out. Every month, reducing them frees up hundreds.

Use tax-free accounts → Contribute funds to the FHSA (First Home Savings Account). This will let you achieve your goal more quickly and grow tax-free.

Invest wisely → If you want to buy a house within a 3-5 year time limit, think about low-risk assets like ETFs or GICs.

Keep an eye on everything → Use apps that display your savings growth, such as Mint or YNAB, to hold you accountable.

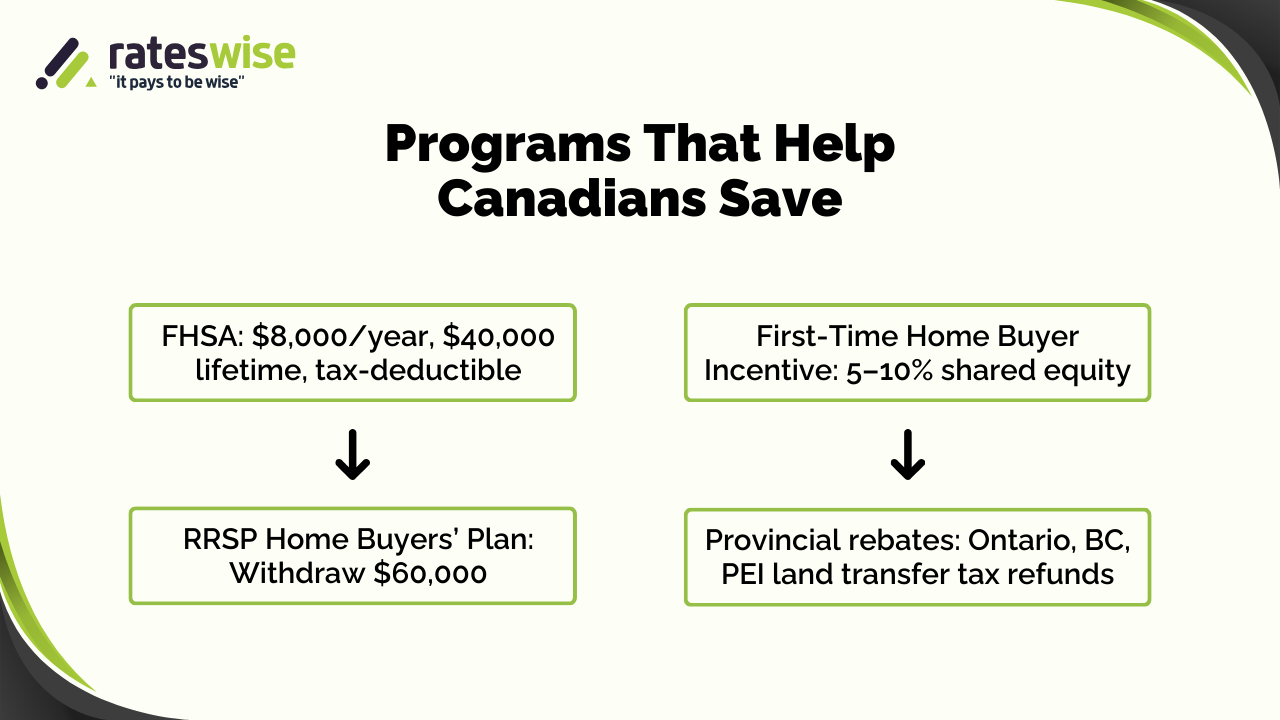

Initiatives that Help Canadians Save for a Down Payment

The Canadian government provides resources to facilitate saving:

FHSA, or the First Home Savings Account: Contribute up to $8,000 annually, with a maximum of $40,000. donations that are tax-deductible, plus tax-free withdrawals for your first property.

Home Buyers' Plan (HBP) for RRSPs: Take out a down payment of up to $60,000 from your RRSP. Repay within 15 years.

First-Time Home Buyer Incentive: To reduce mortgage payments, the government lends 5–10% of the home's purchase price.

Land Transfer Tax Rebates: First-time buyers in Ontario, British Columbia, and Prince Edward Island are eligible for partial land transfer tax rebates.

Case study: In just three years, a 29-year-old girl in Toronto saved $55,000 by combining her RRSP and FHSA. "I would still be renting if these programs didn't exist."

When to Start Saving for a House Down Payment

Now is the ideal moment, but these are signs that you're prepared:

- Your debt load is under control, and your income is consistent.

- You intend to purchase within three to five years.

- You're prepared to spend less on unnecessary things.

- You know what you can afford because you looked up current mortgage rates.

- According to rate surveys conducted by the Bank of Canada, the average 5-year fixed mortgage rate in Canada as of September 2025 is approximately 4.5%. This implies that you could save thousands of dollars in interest over the course of your mortgage if you make a greater down payment.

How to Save for a Down Payment and Get the Best Outcomes

To optimize your savings, take the following actions:

- Establish a specific goal → Determine the precise amount you require.

- Select the appropriate account → TFSA for flexible growth, FHSA for tax benefits.

- Reduce living expenses → even $300 a month might build up to $10,800 over three years.

- Boost revenue → Side projects, overtime, or freelancing might expedite the process.

- Remain consistent → When habits are automatic rather than dependent on incentive, savings increase.

Testimonial

"Rateswise provided me with the necessary road map." I estimated that it would take me ten years to save for a down payment on a home, but the FHSA approach has me on target in just four weeks. A client from Ottawa shared this review, and woah, we really made it.

FAQs

What is the quickest way for Canadians to save money for a down payment?

Reduce unnecessary expenses, add additional revenue streams, and automate savings into a TFSA or FHSA.

Does 2025 make it worthwhile to save for a down payment?

Yes. A substantial down payment reduces your monthly expenses and strengthens your position as a buyer, especially since mortgage rates are stable at 2.75% and housing prices have stabilized in many provinces.

Is it possible for parents to give money as a down payment?

Yes. A gifted down payment is accepted by many lenders, but it needs to be accompanied by a signed "gift letter" clarifying that it is not a loan.

Does purchasing a home in Canada require a 20% down payment?

No. If you have less than $500,000, you can purchase with as little as 5% down. However, 20% do not pay CMHC insurance charges.

People Also Ask

In Canada, how long does it take to save money for a down payment?

It takes three to seven years for the majority of Canadians, depending on their spending patterns, region, and income.

Can I combine my FHSA and RRSP?

Yes. To optimize your tax advantages and savings, you can combine the two plans.

So, are you ready to take the next step?

Check today’s best mortgage rates

Talk to a Rateswise expert today

About the Author

The Rateswise Team

Our team has years of expertise working with investors, first-time buyers, and families moving up to larger houses to help Canadians save and find the best mortgage alternatives. Each guide we publish reflects our experience in helping Canadians understand how careful planning makes homeownership possible.

Disclaimer

This content is based on current facts and intended purely for informational purposes. Always ask your lender about current details.